Daily Market Outlook, June 3, 2024

Munnelly’s Macro Minute…

“ECB & US Payrolls Data The Macro Drivers For The Start of June”

Asian equity markets kicked off the week positively amid fluctuating expectations for global interest rates, especially in the US. Late Friday, US data confirmed April inflation expectations based on the Fed's preferred PCE deflator measure, but also indicated weaker consumer spending, which led to lower US Treasury bond yields and put pressure on the US dollar. Meanwhile, China's Caixin manufacturing PMI increased to 51.7, reaching its highest level in nearly two years.

As we enter June, there are two major market events to look forward to at the end of the week. The European Central Bank will announce its rate decision on Thursday, followed by the release of U.S. non-farm payrolls on Friday.

The U.S. has a busy data schedule ahead, including ISM manufacturing PMI, factory orders, JOLTS job openings, ISM services PMI, and weekly jobless claims. The non-farm payrolls report previously showed a gain of 175,000 jobs.

In the eurozone, German industrial production will be the highlight of a light data calendar. The ECB is expected to reduce rates by 25 basis points to 3.75% on Thursday, but may take a cautious and data-driven approach to further cuts as inflation eases. ECBWATCH predicts 57.74 basis points of cuts for 2024.

The UK will have a quiet week with construction PMI’s being the only significant data release, investor attention will be on the upcoming July 6th election, with party manifesto’s likely to be published later this week.

There is little notable data expected from Japan this week, so focus may shift to Bank of Japan Deputy Governor Ryozo Himino's panel discussion on business and the economy on Tuesday. Additionally, BOJ board member Toyoaki Nakamura will deliver a speech and hold a press conference on Thursday.

There are no scheduled Fed speakers this week in the lead-up to the June 11-12 monetary policy meeting. Overall, market positioning anticipates that the US data will support the Fed's current position to keep interest rates steady for a while longer, possibly until late in the year when markets start to factor in the first rate cut.

Overnight Newswire Updates of Note

Fed’s Kashkari Says Interest Rates Should Stay On Hold For ‘Extended’ Time

Key Engines Of US Consumer Spending Are Losing Steam All At Once

Homebuyers Are Starting To Revolt Over Steep Prices Across US

China’s Defence Chief Turns Down Temperature On Tensions With US

China Steps Up Warning To EU Just Days Before Tariff Decision

Caixin PMI Signals Faster Mfg Growth In Contrast To Official Gauge

Japan’s Firms Trim Spending, Reflecting Headwinds To Growth

RBA Seen As The Only Other Major Central Bank At Risk Of Hiking

Australia Raises Minimum Wage 3.75%, Aiding RBA Inflation Fight

OPEC+ Agrees To Extend Production Cuts In Bid To Boost Oil Prices

Nvidia Unveils Next Generation Of AI Chips In Bid To Entrench Lead

AMD Announces Future AI Chips, Will Speed Rollout Of New Models

Netanyahu Shrinks From Ceasefire Plan As Far-Right Ministers Revolt

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0805 (1.4BLN), 1.0835-45 (750M), 1.0850 (1BLN)

1.0855-60 (1.2BLN), 1.0870 (1.4BLN)

USD/CHF: 0.9000 (200M), 0.9025 (250M). EUR/CHF: 0.9875 (350M)

GBP/USD: 1.2725 (229M)

EUR/SEK: 11.5650 (300M)

AUD/USD: 0.6625 (540M), 0.6640-50 (318M)

USD/CAD: 1.3620-30 (426M)

USD/JPY: 157.00 (931M), 158.00 (861M)

CFTC Data As Of 31/05/24

Japanese yen net short position is -156,039 contracts

Euro net long position is 57,572 contracts

Swiss franc posts net short position of 44,366 contracts

British pound net long position is 25,402 contracts

Bitcoin net short position is -756 contracts

Equity fund managers raise S&P 500 CME net long position by 31.431 contracts to 978,007

Equity fund speculators increase S&P 500 CME net short position by 12,145 contracts to 330,057

Gold NC Net Positions increased to $236.6K from previous $229.8K

Technical & Trade Views

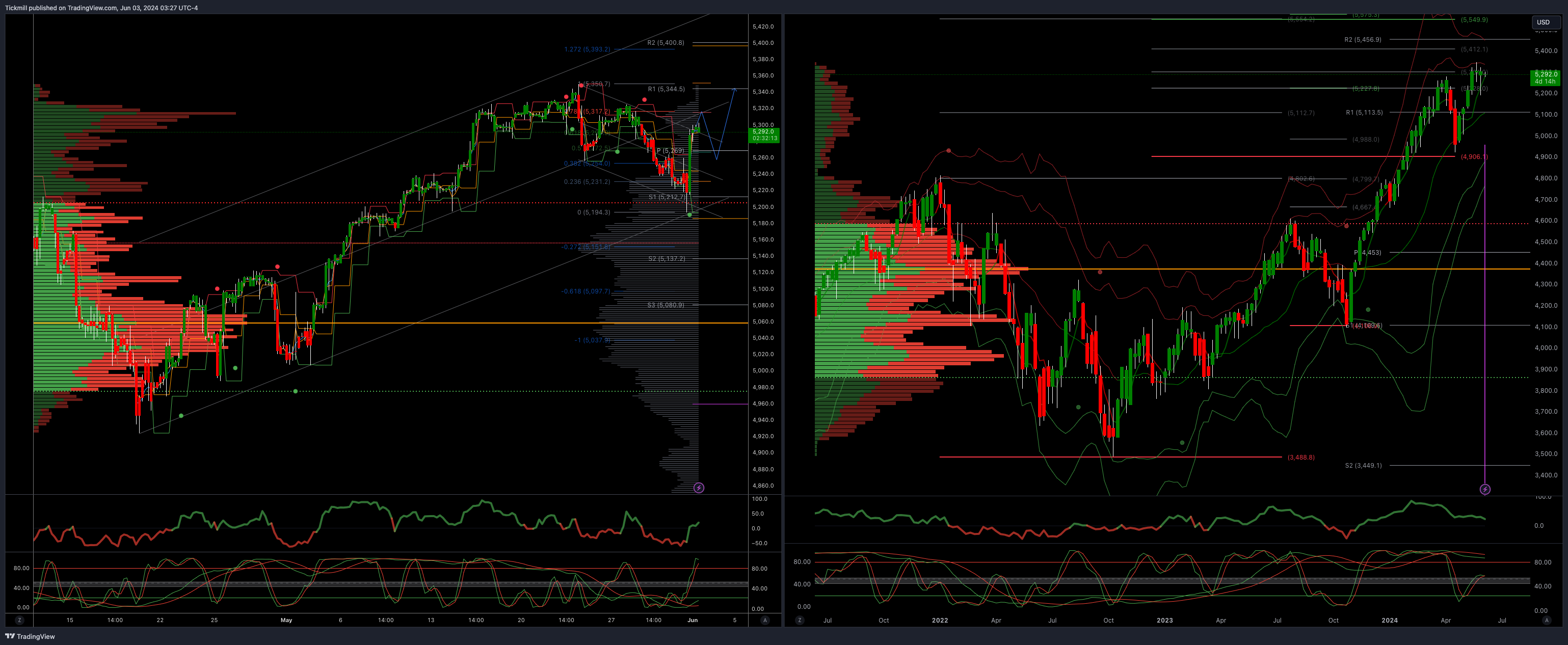

SP500 Bullish Above Bearish Below 5270

Daily VWAP bullish

Weekly VWAP bullish

Below 5230 opens 5190

Primary support 5190

Primary objective is 5379

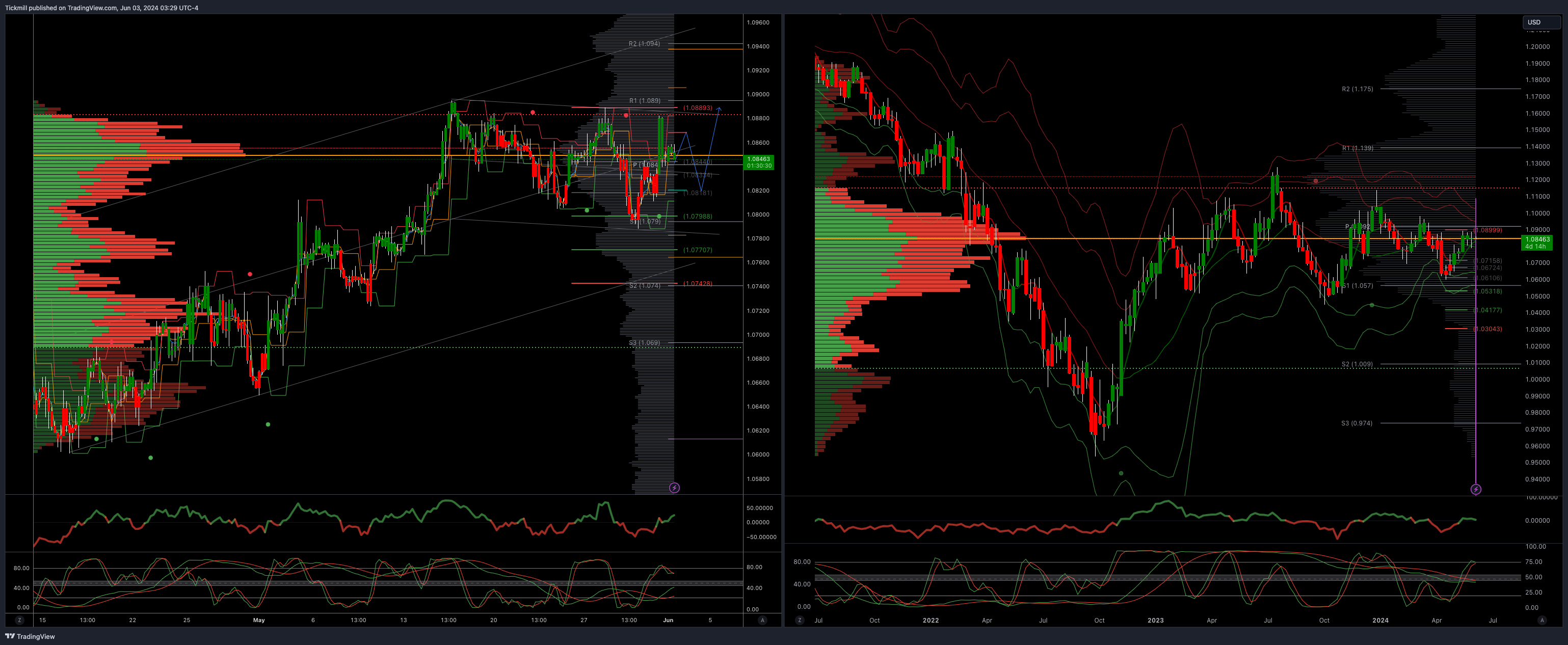

EURUSD Bullish Above Bearish Below 1.0830

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0550

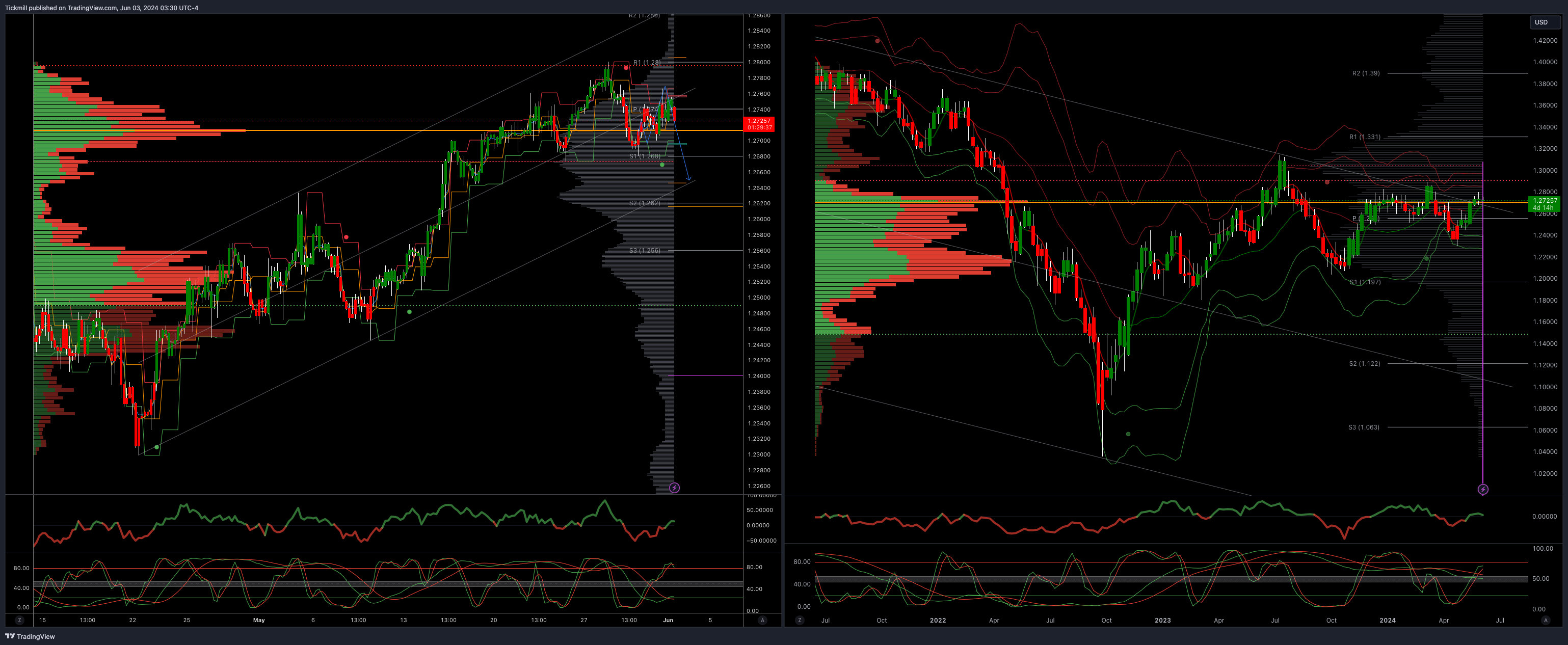

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2700 opens 1.2640

Primary support is 1.2590

Primary objective 1.2640

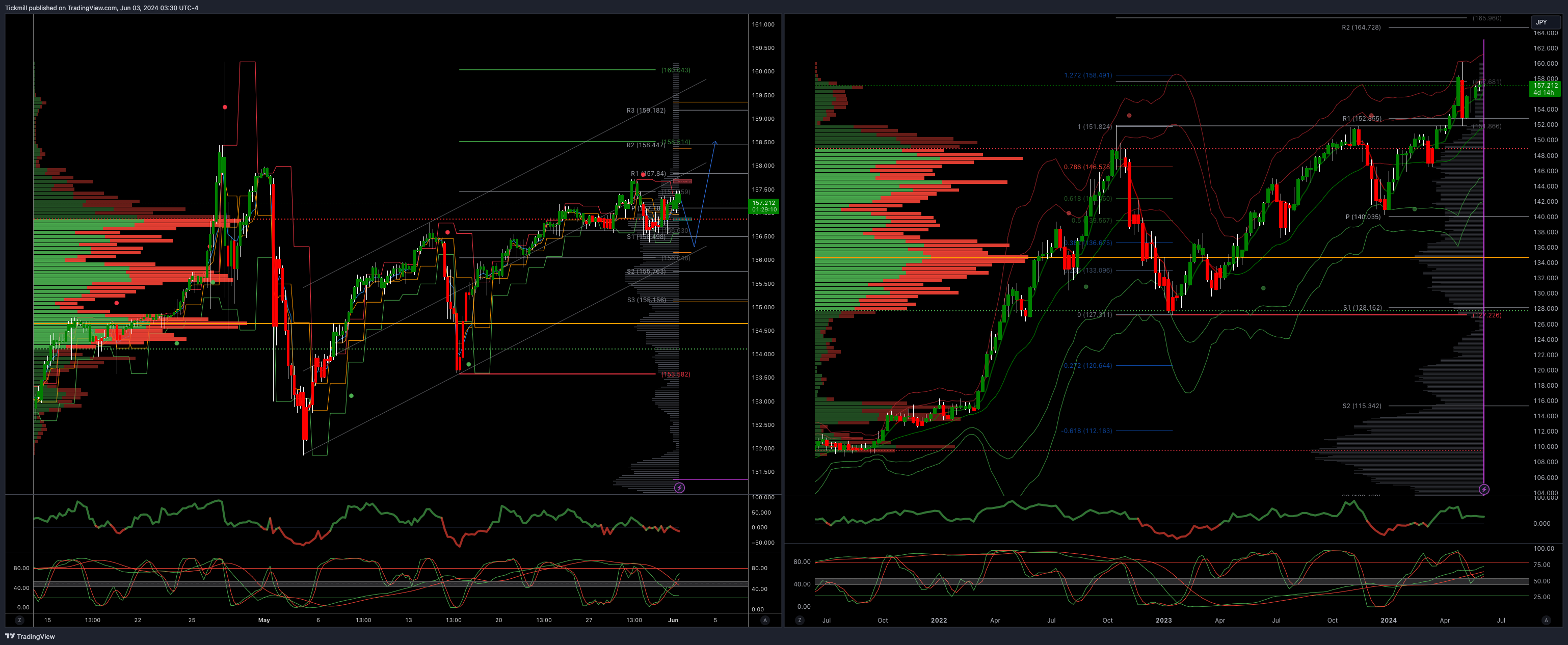

USDJPY Bullish Above Bearish Below 156

Daily VWAP bullish

Weekly VWAP bullish

Below 156 opens 154.50

Primary support 152

Primary objective is 165

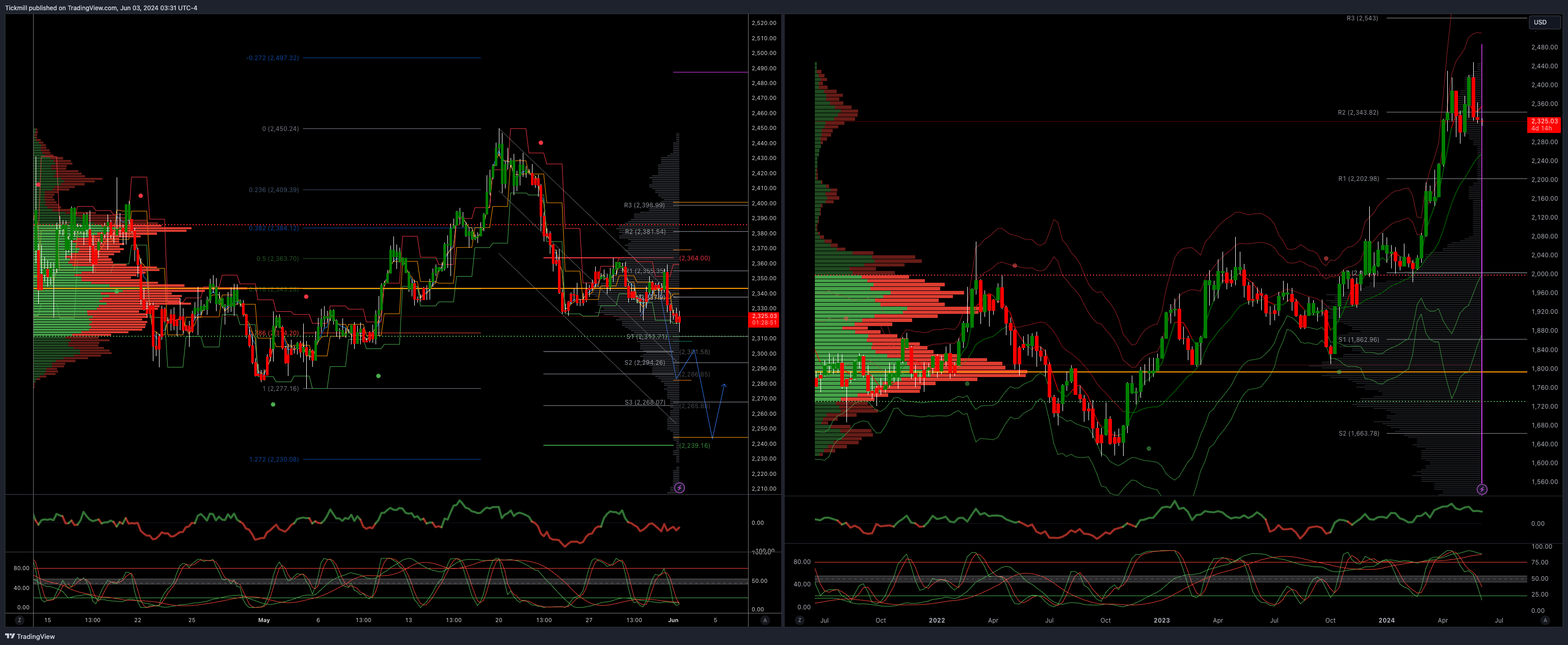

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bearish

Above 2365 opens 2390

Primary support 2300

Primary objective is 2239 Below 2300

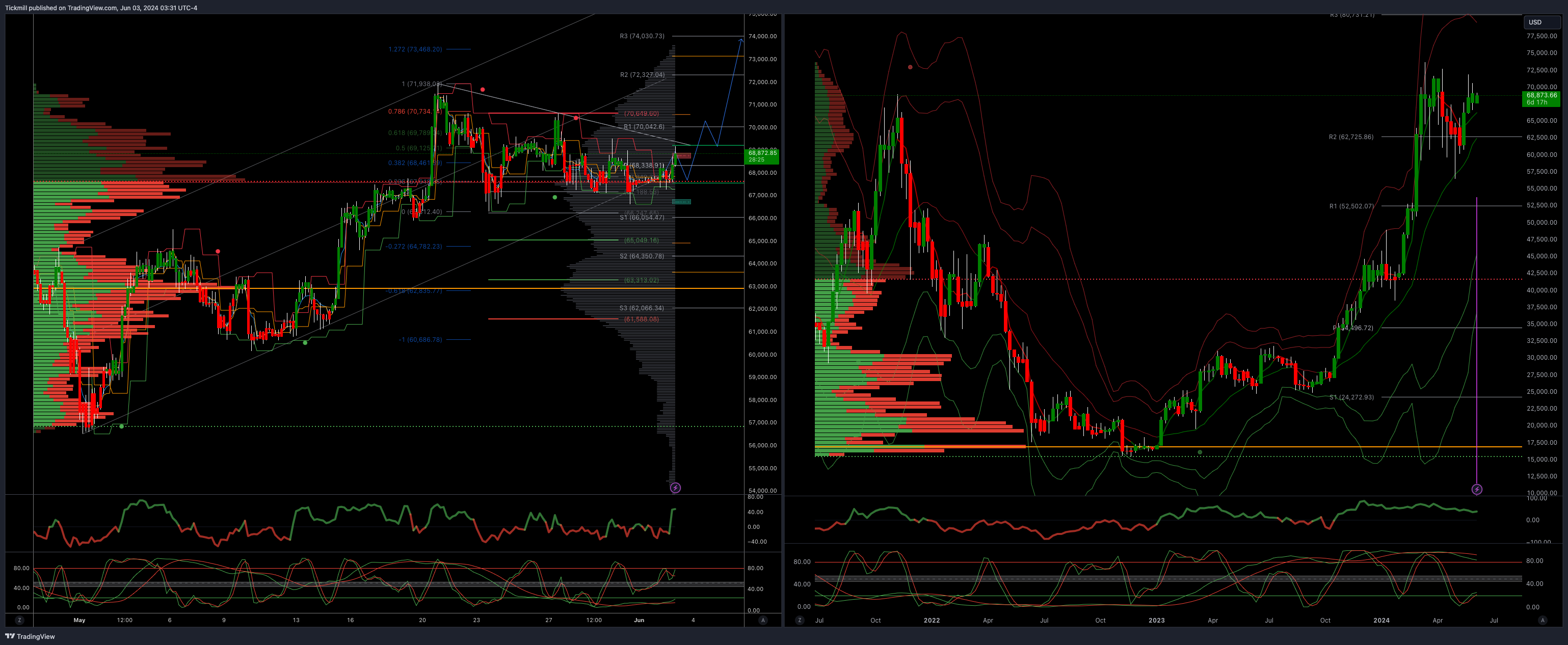

BTCUSD Bullish Above Bearish below 67000

Daily VWAP bearish

Weekly VWAP bullish

Below 67000 opens 65500

Primary support is 65000

Primary objective is 73400

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!